The Role of Technological Advancements in Forex Trading

Key Takeaways

- Forex trading has become more accessible due to technology.

- Modern tech, like trading bots and mobile apps, is revolutionizing the industry.

- Formulating an effective trading strategy is crucial for success.

- Understanding both fundamental and technical analysis enhances trading outcomes.

- Automation and cryptocurrencies are shaping the future of forex trading.

Table of contents

In our digital era, forex trading has never been more accessible. With advancements in technology, traders worldwide can access international currency markets from their desktop computers or even their mobile devices.

The Importance of Trading Strategy

Successfully navigating the forex market goes beyond using the best platform. It involves forming a viable trading strategy.

Factors Influencing Trading Strategy

Your strategy will be influenced by your financial goals, risk tolerance, trading style, and your knowledge and understanding of the forex market.

Common Trading Strategies

These include scalping, day trading, swing trading, and position trading. Each has its own set of techniques and methods.

Choosing the Right Strategy

Finding the right strategy requires some trial and error. Try out different strategies on a demo account before committing real money. Further reading on strategies: Forex Trading Strategies.

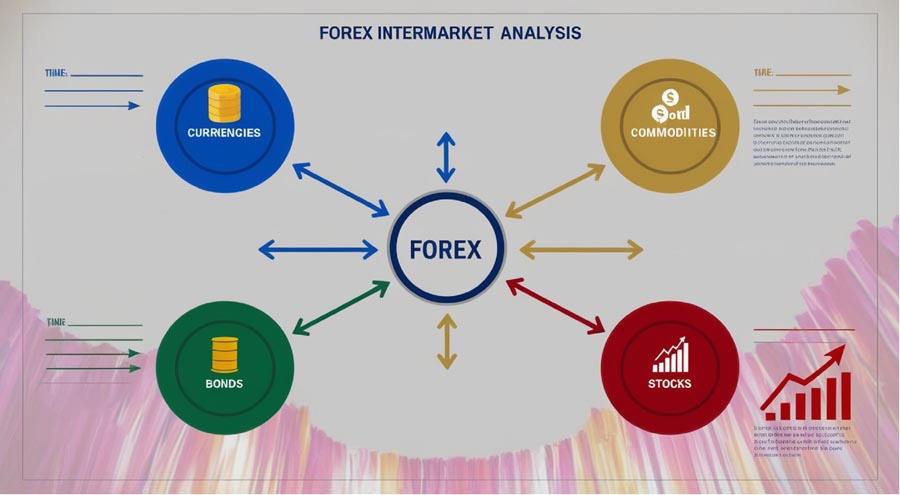

Analysing the Forex Market: The Basics

Gaining a deep understanding of the forex market is fundamental to successful trading. Learn key strategies, trading hours, regulations, and market trends to succeed.

The Importance of Fundamental Analysis

This involves analysing the economic, social, and political forces that may affect the supply and demand of an asset.

The Importance of Technical Analysis

Technical analysis involves statistical trends gathered from trading activity, such as price movements and volume.

Factors Influencing Currency Prices

These include interest rates, inflation, political stability, and economic performance among others. You can gain in-depth knowledge here: What moves the forex market.

The Pitfalls of Forex Trading: Avoiding Common Mistakes

Forex trading can be a highly profitable venture, but – like any investing activity – it also comes with its share of risks and challenges. Discover how to choose top forex brokers while analyzing central bank statements.

Overtrading and High Leverage

Overextending yourself can lead to significant losses. Remember to always trade within your means.

Lack of Risk Management

Not setting up proper stops can put your entire trading account at risk in case of a market downturn.

Succumbing to Emotions

Emotions can cloud judgment and lead to poor trading decisions. Try to remain objective at all times. Check here for common trading mistakes and how to avoid them: Common Forex Trading Mistakes.

Looking to the Future of Forex Trading

Forex trading is quickly evolving, and traders who stay ahead of these trends will have the best chance of success. Master analyzing central bank statements forex, tracking forex central bank speeches, and trading central bank news for smarter moves.

Benefits of Automation in Forex Trading

With the advent of technologies like AI and Machine Learning, more and more aspects of forex trading are becoming automated.

Cryptocurrency in Forex Trading

Cryptocurrencies are currently influencing the foreign exchange markets, leading to the advent of forex-crypto trading pairs on many platforms.

Regulations and Forex Trading

Government regulations and policies impact forex markets, the way currencies are traded, and the brokers and platforms involved. To stay updated on trends in Forex markets visit: Forex Trading News.

Frequently Asked Questions

What are the key technological advancements in forex trading?

Key advancements include high-speed trading platforms, mobile applications, and the utilization of AI in market analysis.

Why is a trading strategy important?

A trading strategy helps traders manage risk, stay disciplined, and enhance their potential for profit.

How can I avoid common trading pitfalls?

Setting clear stop-loss orders, maintaining emotional control, and properly managing leverage can help in avoiding common mistakes.

What impact do cryptocurrencies have on forex trading?

Cryptocurrencies introduce new trading pairs and can influence market trends and volatility in the forex markets.

Where can I find more information on forex trading?

Visit resources like BabyPips and ForexLive for extensive information.